Why the Best Trading Systems Are Designed to Fail

- FinancialWisdom

- 2 hours ago

- 6 min read

The most successful traders in history are built to fail — repeatedly.

Summary:

Most traders believe success comes from being right as often as possible. In reality, the most successful trading systems are built on the opposite principle: frequent failure. Legendary traders such as Mark Minervini, Nicolas Darvas, and Kristjan Qullamaggie design their strategies to accept many small losses while positioning for rare, outsized winners. The video above explains why win rate alone is a misleading metric, how asymmetrical risk-to-reward creates positive expectancy, and why systems that tolerate failure are psychologically easier to follow and mathematically more robust. By understanding how payoff, risk control, and discipline interact, traders can build strategies that remain profitable over the long run, even when most trades fail.

Download our FREE trading strategy for a similar trading principle used for stocks:

Why the Best Trading Systems Are Designed to Fail

The most successful traders in history are built to fail — repeatedly.

Mark Minervini, Kristjan Qullamaggie, and Nicolas Darvas all accept frequent small losses as the unavoidable cost of finding rare, outsized winners. Their systems expect failure, and paradoxically, they profit because of it.

Most traders, however, chase a high win rate. The belief is simple: winning more must mean earning more. Unfortunately, this thinking is deeply flawed. A single large loss can wipe out dozens of small wins, often leaving traders with a losing account despite “being right” most of the time.

High Win Rate vs High Payoff: Two Very Different Traders

Let’s compare two trading models.

Trader A: The 90% Win Rate Trader

Trader A targets a 90% win rate. To achieve this, they must:

Take profits quickly

Allow losing trades more room to “come back”

Delay accepting losses

This creates an asymmetrical risk profile:

Small rewards

Large losses

In effect, Trader A builds a system that demands loss avoidance. They can only afford to be wrong once every ten trades. One mistake too many, and the system breaks.

Trader B: The 30% Win Rate Trader

Trader B uses the opposite philosophy:

Small, predefined losses

Large, open-ended winners

Tight loss confirmation

Patience with winning trades

This creates asymmetrical reward:

Small losses

Large gains

Trader B can afford to be wrong seven times out of ten and still make money. Failure is built into the system.

Why Systems That Allow Failure Are Easier to Trade

Psychologically, it is far easier to stay disciplined when you expect to be wrong most of the time.

Knowing that losses are normal removes emotional pressure. By contrast, a system that requires you to be right constantly becomes mentally exhausting. The fear of being wrong leads traders to:

Take profits too early for validation

Hold losing positions too long

Increase risk to avoid admitting a mistake

This is why many traders end up with large losses and small wins — not because of poor analysis, but because of human psychology.

The Maths Behind Asymmetrical Reward

Let’s put numbers to the theory.

Example: 30% Win Rate with Large Winners

10 trades

7 losing trades at –1R each = –7R

3 winning trades at +5R each = +15R

Net result:+8R over 10 trades

If 1R = $100, that’s $800 profit, despite losing 70% of the time.

This is why the phrase exists (and is often misquoted):

Cut your losses short and let your winners run.

Example: 90% Win Rate with Hidden Risk

To win 9 out of 10 trades, Trader A must allow significant drawdowns.

9 winning trades at +1R each = +9R

1 losing trade at –9R = –9R

Net result: Break-even at best — and one additional loss pushes the system deeply negative.

This is why very high win rates often hide significant, undisclosed risk.

The Two Key Takeaways

If there are only two lessons to take forward, they are these:

Win rate doesn’t matter — payoff does

A system that can’t tolerate being wrong is a system waiting to break

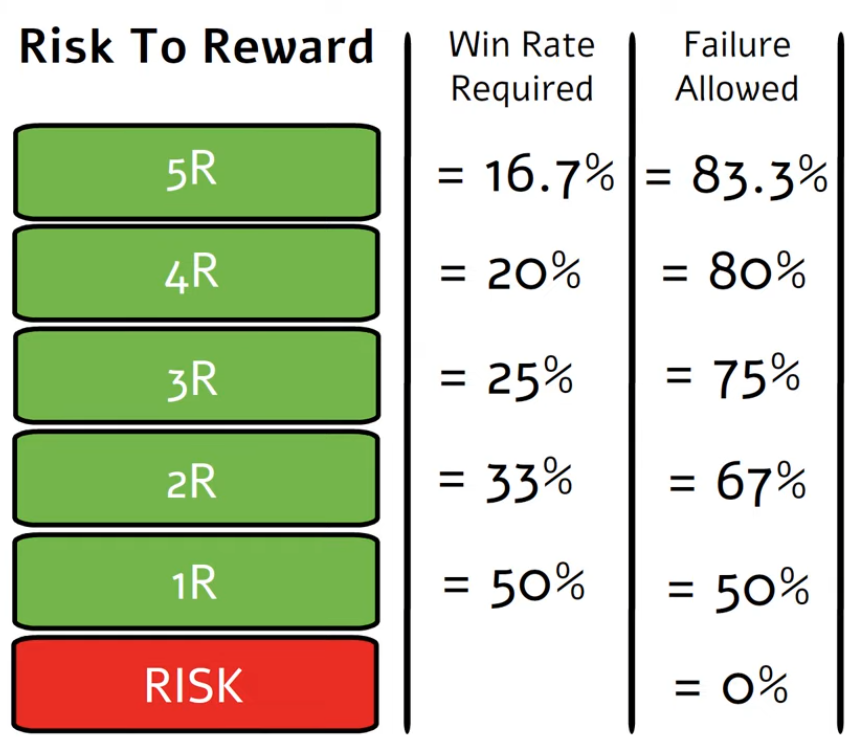

As reward increases relative to risk, the win rate required for profitability collapses. This is how you design a system that survives uncertainty.

Why Low Win Rate Systems Are More Robust

A system targeting high reward-to-risk:

Does not demand accuracy

Is tolerant of error

Reduces emotional strain

Encourages discipline

The opposite is true for low reward-to-risk systems. They require precision, emotional control, and near-perfect execution — something most traders cannot sustain long term.

Real Results: Expectancy in Practice

We apply this exact philosophy within our group.

Average reward: ~3.5R

Win rate: just under 50%

The equity curve reflects one unavoidable truth:

Even the best systems experience periods of underperformance.

Positive expectancy only works if you allow the law of large numbers to play out. Discipline is non-negotiable.

Finding a System That Fits You

The question is always the same:

How do I find a system with positive expectancy?

There are countless valid approaches. The right one depends on your personality, patience, and lifestyle.

After decades of testing strategies, timeframes, and theories, I settled on weekly consolidation breakouts. They offer:

Asymmetrical reward

Defined risk

Fewer decisions

A more passive, sustainable approach

We’ve built a bespoke breakout scanner to identify these setups and provide structure where it matters most: risk first, reward second.

Final Recap

High win rates are often a mirage

Hidden risk is the silent killer

Systems that allow failure are easier to follow

Easier systems are more likely to succeed

Positive expectancy only matters if you can stick to it

Design your trading to survive being wrong — not to avoid it.

If you want more on expectancy, risk-to-reward, or the strategy I personally use, explore the related videos and resources below.

If you want to see our stock trading approach built on similar approaches.:

Download the Free strategy PDF

Explore the Bespoke breakout scanner

Join the group where I share trades, portfolio management, and execution logic in real time

Those interested in a structured, rules-based approach can explore the Financial Wisdom Strategy Blueprint, available free, which outlines a complete framework refined over decades.

Related Reading

Inside the Financial Wisdom Weekly Consolidation Breakout Framework

Risk Management in Trading: The Foundation of Long-Term Profitability

Frequently Asked Questions

Why do the best traders accept frequent losses?

Because small, controlled losses are the cost of accessing rare, outsized winners. Traders like Minervini, Darvas, and Qullamaggie design systems where losses are expected, limited, and quickly cut, allowing profits to compound when big trends emerge.

Is a high win rate bad in trading?

A high win rate isn’t bad by itself, but it often hides poor risk management. Many high win-rate systems rely on small gains and large losses, meaning one losing trade can erase months of progress.

What matters more: win rate or risk-to-reward?

Risk-to-reward matters more. As reward increases relative to risk, the win rate required to be profitable drops dramatically. A system with a low win rate but high payoff can outperform a system with a high win rate and poor payoff.

How can a trader be profitable with only a 30% win rate?

If winning trades are several times larger than losing trades, profitability follows. For example, winning 3 out of 10 trades at 5R while losing 7 trades at 1R still results in a net gain.

Why do traders struggle with asymmetrical risk systems?

Human psychology prefers being right. This leads traders to take profits too early and hold losses too long. Asymmetrical systems require emotional maturity and discipline to allow winners to grow while accepting frequent losses.

What is meant by “a system built to fail”?

It’s a system that assumes you’ll be wrong most of the time—but still makes money. It tolerates error, limits downside, and relies on a few large winners to drive long-term results.

Which trading styles benefit most from low win-rate strategies?

Breakout trading, trend following, and momentum strategies benefit the most. These approaches naturally produce many small losses and occasional large gains when major trends unfold.

How can traders find a system with positive expectancy?

There is no single answer. Positive expectancy comes from aligning strategy, timeframe, risk management, and personality. The key is keeping losses small, allowing reward to be a multiple of risk, and applying the process consistently over many trades.

Published by FinancialWisdomTV.com Trading Education | Risk Management | Trading Psychology

Comments