The Ultimate Stock Trading Guide

- FinancialWisdom

- Nov 11, 2024

- 5 min read

Updated: 6 days ago

Fast track your stock trading career in 20 minutes - The best trading guide to date.

Introduction

In this video, we review what is widely regarded as The Ultimate Trading Guide—a highly respected resource within the trading world. Backed by a team of well-known market practitioners, including Oliver Kell and Stan Weinstein, both of whom we’ve covered in previous videos, this 100-page guide is packed with proven trading concepts and practical insights.

Rather than simply summarising the book, the goal of this video is to distil the key ideas so you can understand what actually matters and apply those principles directly to the markets.

The Four Phases of a Trader’s Journey

The guide begins by outlining four distinct phases that most traders pass through.

1. The Unprofitable Phase

This stage is characterised by emotional, unstructured trading. There’s no defined edge, no consistent process, and decisions are often driven by ego. A common pattern here is frequent small wins punctuated by occasional large losses.

Ironically, profitable trading looks almost identical—but in reverse: frequent small losses and occasional large wins. The lesson is simple but critical—without a plan, emotion will always dominate outcomes.

2. The Boom-and-Bust Phase

At this stage, traders begin to take the process more seriously. They learn new setups and experience periods of success, but consistency remains elusive. Equity curves become volatile, and profits are often surrendered during market pullbacks. For many, this is where frustration sets in—and some abandon trading altogether.

3. The Consistency Phase

Here, discipline starts to replace emotion. The trader commits to a defined process, improves risk management, and becomes more aware of market context. Risk-to-reward dynamics flip—losses become smaller, wins larger—and the equity curve begins to trend upward.

4. The Performance Phase

This is the point of mastery. The trader has full confidence in their process and understands precisely when their strategy performs best. Position sizing becomes adaptive, drawdowns are controlled, and returns are maximised through selectivity rather than activity. This phase is sustained through patience, refinement, and unwavering discipline.

The Foundation: Supply, Demand, Price, and Volume

The guide makes an important point early on: trading is not about patterns alone—it’s about supply and demand.

Every candle represents a battle between buyers and sellers. If sellers dominate, price falls. If buyers dominate, price rises. The “slack in the rope” tells you who won that battle—and by how much.

These battles occur on every timeframe and combine over time to form tradable structures. But price should never be analysed in isolation. Volume is the validator.

High volume signals participation—often institutional participation. Think of volume as the size of the crowd watching the battle. The larger the crowd, the more meaningful the outcome.

Price Action and Context: Real Examples

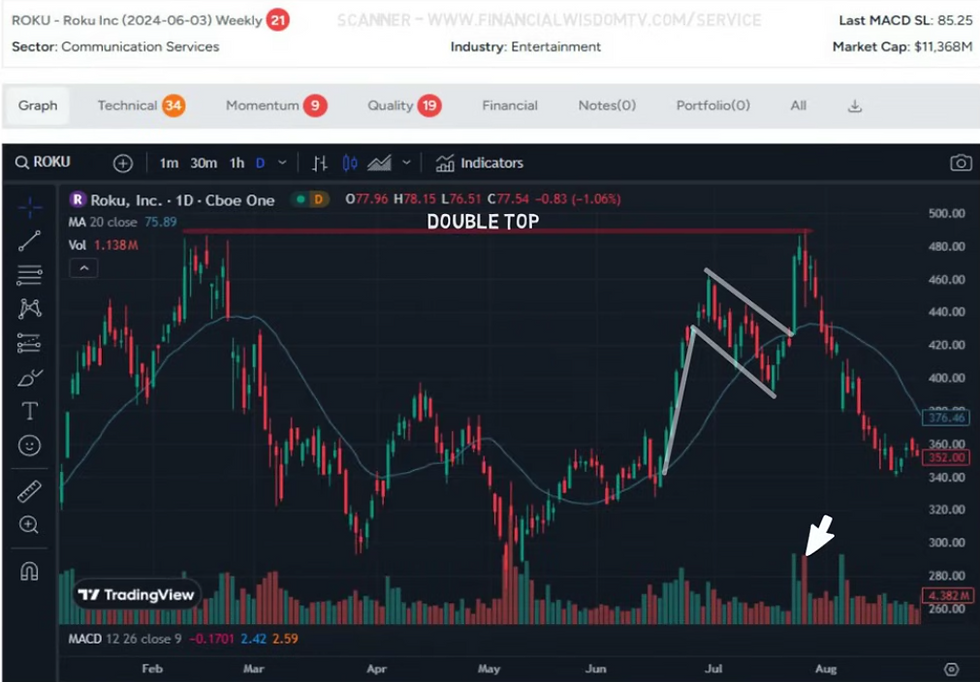

Using examples such as ROKU, the guide demonstrates how volume can reveal distribution even after a seemingly strong breakout. A high-volume rejection at major resistance preceded a significant decline—visible even more clearly on the weekly chart.

One core rule we apply in our own trading is simple: only trade stocks above the 20-week moving average. This alone filters out a large percentage of poor trades and keeps you aligned with the dominant trend.

“What Seems Too High Often Goes Higher”

William O’Neil famously said:

“What seems too high usually goes higher, and what seems too low usually goes lower.”

NVIDIA perfectly illustrates this principle. What looked “expensive” at $1 in 2016 continued higher for years, eventually reaching well over $100. The lesson is clear: don’t judge a stock by its price—judge it by its action.

Tight consolidations, reduced volume, price holding above key moving averages, followed by a high-volume breakout—these are the footprints of institutional accumulation.

Stage Analysis – Stan Weinstein

Stage Analysis provides the broader market framework.

Using the 30-week moving average, Weinstein identifies four stages:

Stage 1: Basing / Accumulation

Stage 2: Advancing

Stage 3: Topping

Stage 4: Decline

A weekly PayPal chart clearly shows this progression. By simply holding stocks only during Stage 2—above the 30-week moving average—you capture the majority of upside while avoiding prolonged drawdowns.

As Weinstein himself warned:

“Never decide you’re going to ride out a Stage 4 decline—there’s no telling how far it will fall.”

Three Setups You Can Master

The guide then outlines three core setups:

Gapper High Volume SetupTypically driven by earnings or major news. A gap-up on strong volume, closing in the upper half of the candle, signals aggressive demand.

Launch Pad SetupCharacterised by moving averages compressing, followed by expansion, volume drying up, and a failed breakout attempt. The eventual high-volume break marks the entry.

Up the Right SideA pyramiding approach—adding as price breaks successive resistance levels during a sustained advance.

All three setups share the same DNA: momentum, volume, and trend

alignment.

Trade Management and Exits

Entries are only half the equation.

The guide stresses that exits should be driven by loss of momentum, often visible through moving average crossovers or structural breakdowns. My own approach uses the weekly MACD to trail stops progressively under price structure—locking in gains while allowing trends to mature.

There is no single “correct” exit—but successful exits all respond to the same underlying signal: weakening demand.

Finding Champion Stocks

Champion stocks share common traits. Studying past winners builds a mental template—making it easier to recognise future leaders.

The guide discusses screening for:

Market leaders

52-week highs

This aligns closely with my own process, which focuses on consolidation breakouts, volume expansion, and trend confirmation—automated through our bespoke scanner.

Risk Management: The Non-Negotiable Edge

Risk management is not optional—it’s foundational.

Large losses require exponentially larger gains to recover. A 50% drawdown needs a 100% gain just to break even. Keeping losses small—typically under 9%, occasionally up to 16% in high-conviction trades—dramatically improves long-term outcomes.

Stops should always be placed logically: at structural levels, key moving averages, or trend boundaries—not arbitrarily.

Position sizing completes the equation. With a $10,000 account and 10 positions, risking 1% per trade caps total portfolio risk at 10%—even in worst-case scenarios.

Final Thoughts

To recap:

Trading mastery is a progression—not a shortcut

Price action and volume reveal institutional intent

Stage analysis keeps you aligned with the dominant cycle

Setups work best within the right market context

Risk management determines longevity

By studying proven frameworks and then tailoring them through experience, you can develop a method that fits you. Scanners and structured processes simply accelerate that journey.

If you’d like to follow my trades, use the scanner, or join a highly engaged group of like-minded traders focused on low-risk, high-reward opportunities, you’ll find the links below.

Access Our Group & Breakout Scanner Here. https://www.financialwisdomtv.com/service

My Brokerage Account (Interactive Brokers) - https://bit.ly/3UGvn1U

Our FREE Strategy Blueprint - https://www.financialwisdomtv.com/service

Related Reading

Risk Management in Trading: The Foundation of Long-Term Profitability

Trading Psychology & Realistic Expectations

Time-Tested Trading Strategies: What Actually Works

Published by FinancialWisdomTV.com Trader Lion | Trading Education | Stage Analysis

For seamless crypto gambling, the TON Coin Calculator on (check more info here ) TONCasinos.com is a game-changer. Quickly convert TON to your preferred currency, including BTC, ETH, and USDT, to make informed betting decisions. Whether you're using Telegram casino bots or traditional platforms, this tool simplifies bankroll management. Stay updated with real-time rates and bet with confidence!