The Truth About Stock Valuations Tesla, Palantir, NVIDIA etc

- FinancialWisdom

- Jan 9, 2025

- 5 min read

Updated: Jan 5

Valuations Explained: Why “Expensive” Stocks Can Still Be the Best Trades

Do valuations matter that much?

Valuation is the process of estimating what a stock is worth, but its relevance depends entirely on your trading or investing style. This article explains the three main valuation methods, why price and value often diverge, and why relying on traditional valuation metrics alone can cause traders to miss some of the market’s biggest winners. You’ll also learn why momentum-driven strategies often outperform valuation-led approaches during strong growth cycles.

Introduction

In today’s video, we discuss valuations, what they are, how investors use them, and why they often divide opinion in stock trading and investing.

Valuation is a complex and highly subjective concept. Its perceived importance varies not only between investors, but also across different market environments.

To understand why, consider a simple real-world example.

Price vs Value: The Coke Analogy

Imagine buying a can of Coke from a discount store versus ordering the same Coke in a luxury hotel room.

Both drinks quench your thirst in exactly the same way. Yet the hotel Coke might cost several times more. The difference in price reflects context and service, not the product itself.

Some people are happy to pay the premium for comfort and convenience. Others see no justification and would rather buy the cheaper Coke and drink it in the hotel room anyway.

This same dynamic plays out every day in the stock market.

A buyer and seller agree on a transaction price, but their perception of value can be completely different. The buyer believes the stock is undervalued and will rise.

The seller believes it is overvalued and chooses to exit.

When Valuation Fails: The Palantir Example

A recent example of valuation disagreement was Palantir.

In August 2024:

Palantir traded on a PE ratio of 70

The average PE for tech stocks in the S&P 500 was 28

Stockopedia assigned it a value score of 2/100

By conventional valuation standards, Palantir looked extremely expensive.

At the start of August, the stock traded around $30. Just four months later, it had surged to $80, and its PE ratio expanded to 170.

Any investor relying solely on traditional valuation metrics would have missed a nearly 3x move.

This is a recurring theme in growth and momentum stocks, and one of the main reasons valuations are not central to my trading approach.

The Three Main Valuation Methods

Although valuations are not the primary driver of my strategy, they remain foundational for many investors. Broadly, there are three main valuation approaches.

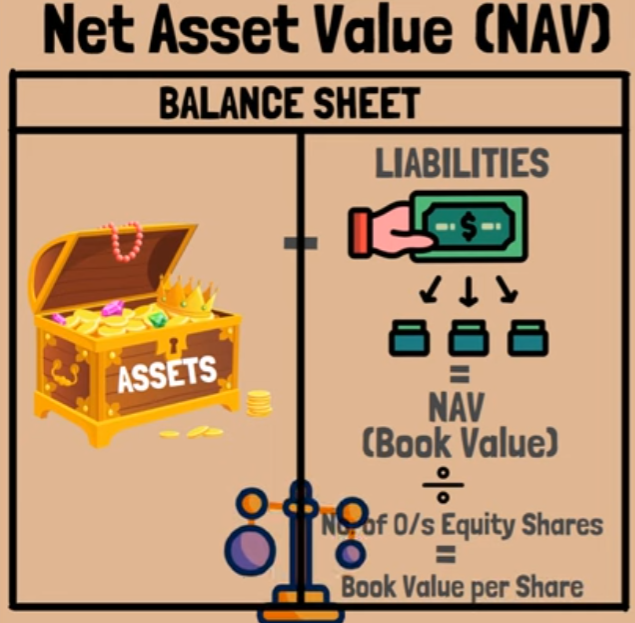

1. Asset-Based Valuation

The asset-based method values a company using its Net Asset Value (NAV):

Assets – Liabilities = Net Asset Value

When divided by the number of outstanding shares, this produces the book value per share.

This leads to the Price-to-Book (PB) ratio:

PB < 1 → trading below book value

PB > 1 → trading above book value

Value investors often search for stocks trading below book value, expecting prices to eventually converge with intrinsic worth.

Warren Buffett built much of his early success buying companies trading at or below their book value.

2. Income-Based Valuation

The income-based approach values a stock based on discounted future cash flows or earnings.

For example:

A company paying $5 per share in perpetuity

Discounted at 10%

Implies a valuation of $50 per share

This method accounts for risk via the discount rate:

Higher risk → higher discount rate → lower valuation

Lower risk → lower discount rate → higher valuation

Valuations also fluctuate with market sentiment. During risk-averse periods, discount rates rise and valuations fall. In optimistic markets, investors accept lower risk premiums.

3. Market-Based Valuation

This method compares a stock’s metrics to industry peers.

The most common metric is the Price-to-Earnings (PE) ratio, but others include:

Price-to-Sales

Price-to-Cash Flow

Price-to-Operating Profit

If a company trades at a lower multiple than its peers, it may appear undervalued, though this often ignores growth, quality, and momentum.

Price and Value Are Not the Same Thing

The difference between price and value is critical.

Benjamin Graham explained this through his famous “Mr Market” analogy. Mr Market is emotional sometimes pessimistic, sometimes euphoric. He offers stocks cheaply during fear and expensively during excitement.

Value investors thrive during pessimistic phases when prices fall below intrinsic value. During euphoric markets, however, valuations often expand far beyond what traditional models justify.

Growth Stocks and the Limits of Valuation

In recent decades, valuation metrics have struggled to explain the success of many transformational companies.

Examples include:

Amazon

Tesla

Uber

Biotech innovators

These companies often traded at high valuations long before profitability, driven by future potential, not present earnings.

Tesla: Another Valuation Trap

In August 2024:

Tesla traded on a PE ratio of 76

Stockopedia gave it a valuation score of 5/100

The stock appeared expensive by every traditional metric

Yet Tesla was growing revenues at a 35% CAGR.

At the time, the stock traded near $206. Just over four months later, it had climbed above $450.

Once again, valuation-focused investors were left watching from the sidelines.

How Valuation Fits (or Doesn’t) Into My Strategy

In my own trading approach, valuations take a backseat.

I focus on:

Quality (ROE, margins, growth, balance sheet strength)

Momentum (stocks already trending higher)

Technical structure (breakouts from consolidation)

High-quality momentum stocks often look “expensive” on paper, but strong growth frequently justifies the premium.

Conversely, many undervalued stocks are cheap for a reason. Structural headwinds can keep them depressed for years. While some investors excel at turning these into winners, it’s not my edge.

My edge lies in identifying quality stocks already being accumulated and riding the trend.

When Valuations Matter More

Valuations tend to matter more:

In slow-growth or mature industries

During bear markets and risk-off environments

When liquidity tightens and investors demand higher risk premiums

In strong bull markets, momentum and growth often dominate valuation considerations.

Final Thoughts

Valuations are neither useless nor universally decisive.

For value investors, they are the foundation of decision-making. For momentum traders, they are often secondary to trend, growth, and institutional demand.

Understanding when valuations matter—and when they don’t—is the real edge.

For those looking to follow my trades, use my scanner, or join our group of like-minded traders, you’ll find the links below.

If you want to go deeper:

Download the Free strategy PDF

Explore the Bespoke breakout scanner

Join the group where I share trades, portfolio management, and execution logic in real time

Those interested in a structured, rules-based approach can explore the Financial Wisdom Strategy Blueprint, available free, which outlines a complete framework refined over decades.

Performance:

Related Reading

Inside the Financial Wisdom Weekly Consolidation Breakout Framework

Risk Management in Trading: The Foundation of Long-Term Profitability

My Brokerage Account (Interactive Brokers) - https://bit.ly/3UGvn1U

Comments