A Leading Indicator for Stock Price Direction?

- FinancialWisdom

- Apr 1, 2025

- 5 min read

Updated: Jan 2

What Stockopedia’s “Ahead of Expectations” Study Reveals About Earnings Momentum

25% Stockopedia Discount Code - HERE

Need a leading indicator for future stock price direction?

In today’s market, price rarely moves at random. One of the most powerful and repeatable drivers of sustained share price momentum is earnings surprises—specifically when companies report results ahead of expectations.

In this article, we break down Stockopedia’s “Ahead of Expectations” Study, a data-driven analysis showing how earnings releases influence stock prices not just on the announcement day, but weeks and months afterward. The findings highlight a clear and exploitable phenomenon: post-earnings price drift.

Why Earnings Expectations Matter More Than Earnings Themselves

Company announcements occur at irregular intervals. While annual and half-yearly reports are mandatory, most trading updates are voluntary, meaning their timing and content vary significantly.

Stockopedia analysed over 2,700 UK trading statements across two years, comparing reported figures against market and analyst expectations. Each update was categorised into one of three outcomes:

Ahead of Expectations

In Line with Expectations

Behind Expectations

The results were striking.

When results came in in line with expectations, share prices showed little meaningful movement. There was no surprise—and therefore no catalyst.

But when results were ahead or behind expectations, the market reacted swiftly and decisively.

The Two-Stage Market Reaction to Earnings Surprises

Stockopedia’s research highlights two distinct phases following an earnings announcement:

1. The Announcement Day Reaction

The initial repricing of the stock occurs immediately as new information is absorbed.

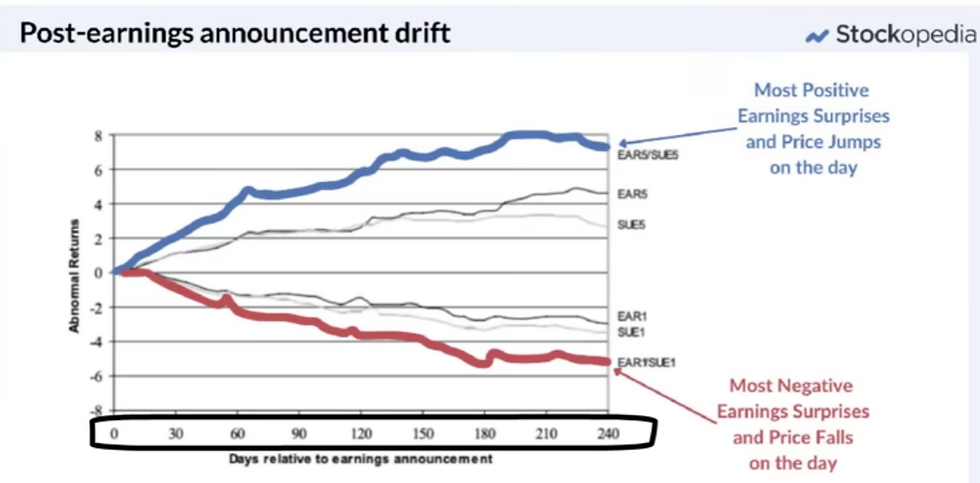

2. The Post-Earnings Drift

Rather than reverting, prices tend to continue moving in the same direction for days, weeks, or even months.

This phenomenon—known as post-earnings announcement drift (PEAD)—has been documented academically for decades. Stockopedia’s study confirms it remains highly relevant and actionable today.

“Significantly Ahead” Is the Keyword That Matters

Not all positive surprises are equal.

Stockopedia found that when companies explicitly used phrases like “significantly ahead of expectations”, the probability of continued outperformance increased dramatically.

Key findings:

Stocks reporting significantly ahead were 31% more likely to beat expectations again in the next update

Only 10% followed with a negative surprise

Repeated positive surprises often led to multi-year price trends

In contrast, profit warnings showed similar clustering behaviour on the downside— once expectations deteriorate, they often continue to do so.

The Size of the First-Day Move Predicts Future Performance

Another crucial insight from the study:

The larger the announcement-day price move, the stronger the next six-month performance.

Stocks that jumped 20% or more on results day often delivered similar gains again over the following six months. The relationship was especially strong on the upside.

This explains why many winning stocks follow a familiar rhythm: earnings surprise → price jump → consolidation → breakout → repeat

It’s the same price behaviour described decades ago by Nicholas Darvas with his famous box theory—and exactly the type of structure we actively scan for.

Case Studies: Earnings Momentum in Action

Yu Group

After its first “significantly ahead” statement in late 2022, Yu Group delivered five consecutive positive surprises. Over 18 months, the stock more than tripled, becoming a textbook multibagger.

Filtronic

A 48% earnings-day jump in May 2024 was followed by a further 97% gain over the next six months—clear confirmation of post-earnings drift.

Sanderson Design (Downside Example)

Four consecutive pessimistic updates beginning in early 2024 resulted in a 50% decline, illustrating how negative surprises also compound.

Why Value Stocks Often Respond Best

One of the most counter-intuitive findings in the study is that lower-expectation value stocks often respond more strongly than popular growth names.

Why?

Less analyst coverage

Lower institutional positioning

Suppressed expectations

When positive news finally arrives, the expectations reset violently, creating powerful momentum.

This is why “ahead of expectations” investing often overlaps with value-to-momentum transitions—a key sweet spot for swing and position traders.

25% Stockopedia Discount Code - HERE

The Three Findings and Three Rules

The Findings

Price momentum continues in the same direction as the announcement-day move

“Significantly” ahead or behind updates produce the strongest drift

Bigger first-day moves lead to stronger future returns

The Rules

Focus on companies with positive earnings updates or streaks

Prioritise large announcement-day price moves

Pay attention to language like “significant” or “material”

How to Use This in Practice

If you own a stock that:

Beats expectations

Jumps sharply on the announcement

Uses strong qualifying language

Don’t rush to sell.

The data suggests staying invested for at least six months to allow the earnings drift to play out. Likewise, when buying, avoid short-term thinking—this is a momentum phenomenon, not a day trade.

While this study focused on UK stocks, the underlying behavioural mechanics are universal and visible across global markets.

Final Thoughts

Stockopedia’s research reinforces a powerful truth: earnings momentum is one of the clearest leading indicators of future price direction.

When combined with:

Quality filters

Momentum confirmation

Sensible risk management

…it can form the backbone of a robust, repeatable stock selection system.

If you want to explore the full study, access the webinar recording, or take advantage of a Stockopedia discount, the link is provided below.

25% Stockopedia Discount Code - HERE

Summary:

Stockopedia’s Ahead of Expectations study shows that earnings surprises are one of the most reliable leading indicators of future stock price direction. When companies report results ahead of expectations—especially when described as “significantly ahead”— share prices tend to rise on the announcement day and continue drifting higher for months.

The research highlights three consistent findings: price momentum continues in the direction of the initial earnings reaction, larger announcement-day moves lead to stronger future returns, and repeated positive surprises dramatically increase the probability of sustained outperformance.

Crucially, many of the strongest performers are not popular growth stocks, but overlooked value stocks with low expectations. When expectations reset, these stocks can transition rapidly into powerful momentum trends.

By focusing on earnings surprise magnitude, announcement-day price behaviour, and confirmation through price and volume, traders can align themselves with institutional flows and capture high-probability post-earnings momentum.

FW Breakout Scanner:

FREE Ebook - https://www.financialwisdomtv.com/service

Membership - https://www.financialwisdomtv.com/plans-pricing

FAQS

1. What is an earnings release?

An earnings release is a quarterly or annual financial report that a publicly traded company issues to disclose its revenue, profits, earnings per share (EPS), and other financial results. Investors use this information to evaluate the company’s performance.

2. How do earnings releases influence stock prices?

Earnings releases influence stock prices primarily through the expectations game. If a company beats analysts’ expectations, its stock often rises. If results fall short, the price can decline. When earnings are in line with expectations, prices tend to move less.

3. Why do stock prices sometimes move sharply after earnings?

Stock prices can jump or fall sharply because earnings reports contain new information that changes investors’ views on a company’s value. Markets are forward-looking, so any surprise—positive or negative—can trigger strong buying or selling.

4. Can stock prices fall even after good earnings?

Yes. Even when earnings beat expectations, prices may fall if future guidance disappoints, investors were expecting even stronger results, or market sentiment is cautious. Investor expectations—not just raw numbers—drive price reactions.

5. What role do earnings expectations play in price changes?

Expectations set a benchmark. Stocks react not just to the actual numbers, but to how those numbers compare with forecasts from analysts and the consensus estimate. A positive surprise generally pushes prices up, while a negative surprise tends to push them down.

Comments