Factor Investing Explained: How Stockopedia Shows We Can Beat the Market

- Nov 29, 2020

- 4 min read

Updated: Jan 4

How Quality, Value, and Momentum Combine to Beat the Market.

Stockopedia Discount Code - HERE

Can the stock market really be beaten using a systematic, evidence-based approach?

According to decades of research — and the data demonstrated by Stockopedia — the answer is yes. Not by prediction or speculation, but by consistently focusing on specific factors that have been statistically linked to long-term outperformance.

This approach is known as factor investing.

In this article, we break down how factor investing works, how Stockopedia quantifies it, and why combining quality, value, and momentum can dramatically improve both returns and the probability of success.

What Is Factor Investing?

Factor investing is a quantitative approach that identifies specific characteristics — or “factors” — that are strongly correlated with stock market returns.

Rather than analysing companies subjectively, factor investing assigns numerical scores to measurable attributes such as:

Quality

Value

Momentum

Growth

Each factor captures a different dimension of a company’s financial and market behaviour. Numerous academic studies and real-world results show that these factors, when applied consistently, can outperform broad market indices over time.

How Stockopedia Quantifies Factors

Stockopedia takes factor investing a step further by scoring every stock from 0 to 100 across individual factors and then combining them into a single composite score.

The most widely used composite is the QVM StockRank, which blends:

Quality

Value

Momentum

Each stock is ranked relative to its peers, and these rankings are rebalanced quarterly, ensuring the system adapts as company fundamentals and market conditions change.

Stockopedia Discount Code - HERE

The Evidence: Factor Scores vs Market Returns

Stockopedia’s long-term data paints a clear picture.

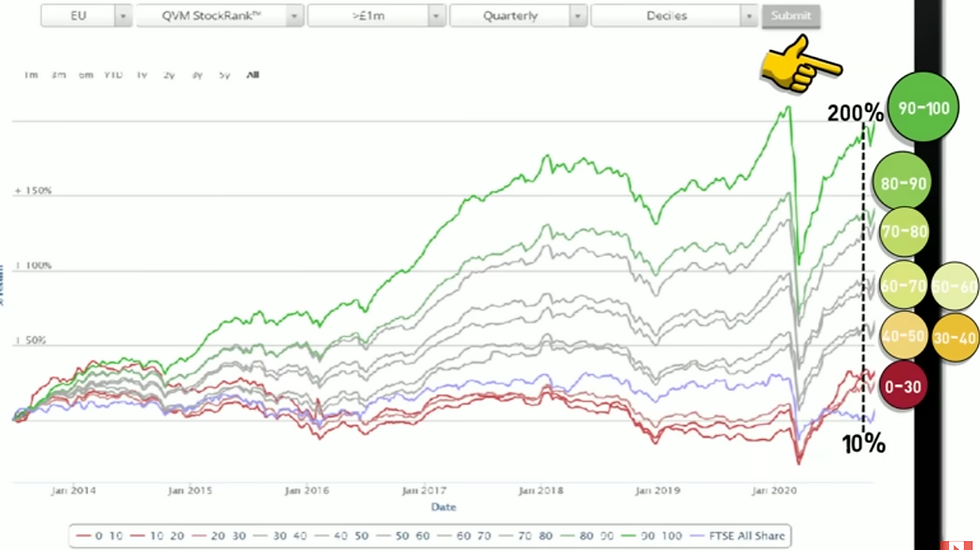

Using the European stock universe as an example, portfolios were constructed based on QVM StockRank ranges:

Stocks ranked 90–100 (highest quality, value, and momentum)

Stocks ranked 80–90

All the way down to 0–30 (lowest ranked stocks)

The results are striking.

While the FTSE All-Share Index delivered a return of around 10% over the same period, a portfolio of stocks ranked 90–100 generated returns of approximately 200%.

Just as important as returns is probability. The highest-ranked stocks didn’t just outperform — they also won more often.

Why Combining Factors Matters

Each factor works on its own, but their real power emerges when combined.

Quality filters out weak, fragile businesses

Value avoids overpaying for growth

Momentum keeps you aligned with improving trends

This mirrors how professional investors operate: buy good companies, at sensible prices, that are already moving in the right direction.

This is also the same logic that underpins my own approach — fundamentals first, followed by selective technical analysis to refine entries and manage risk.

Breaking Down the Core Factors

1. Quality: The Foundation

A quality company typically exhibits:

Strong profitability

Healthy margins

Positive and consistent cash flow

Sensible debt levels

Adequate liquidity

Stockopedia’s data from 2013 to 2018 shows a near-perfect correlation between quality rankings and annual returns.

Lowest quality stocks (ranked 0–10): –12.5% average annual return

Highest quality stocks (ranked 90–100): ~13% average annual return

Simply avoiding low-quality companies dramatically improves outcomes.

2. Value: Avoiding Overpayment

Value investing focuses on how much you pay for a company relative to what you get.

Stockopedia evaluates value using metrics such as:

Price-to-earnings

Price-to-book

Price-to-sales

Price-to-free-cash-flow

Dividend yield

Earnings yield

Stocks with the worst value scores produced average losses of around –4% per year, while the cheapest stocks delivered 10%+ annual returns.

Even momentum traders benefit from avoiding stocks that are fundamentally overpriced.

3. Momentum: The Leading Indicator

Momentum is the factor I personally place the greatest emphasis on.

Stockopedia splits momentum into two categories:

Price Momentum

Proximity to 52-week highs

50-day vs 200-day moving averages

Relative strength over 6–12 months

Earnings Momentum

Upgrades to earnings expectations

Positive earnings surprises

Momentum captures improving businesses — the stocks institutions are already accumulating.

Over the same six-year period, the highest-ranked momentum stocks produced average annual returns of around 20%, significantly outperforming lagging stocks.

The Power of the Combined QVM StockRank

When Quality, Value, and Momentum are combined, the results improve further.

Not only do returns increase — the odds of selecting a winning stock rise sharply.

Lowest-ranked stocks: ~33% probability of being profitable over 12 months

Highest-ranked stocks: ~67% probability of success

That difference alone can transform long-term performance.

Factors Across Sectors and Market Caps

The benefits of factor investing are not confined to one sector.

Stocks ranked 80–100 showed strong returns across multiple sectors, from Healthcare to Industrials and Technology. In contrast, stocks ranked 0–20 failed to deliver positive returns in any sector.

Across market capitalisations:

Microcaps showed the highest returns, albeit with higher volatility

Large and mid-cap stocks still demonstrated strong factor-driven outperformance

Low-ranked stocks consistently underperformed, regardless of size

Why Factor Investing Works

Factor investing works because it aligns with human and institutional behaviour:

Quality attracts long-term capital

Momentum reflects institutional accumulation

Value reduces downside risk

Rather than guessing which stock might outperform, factor investing systematically improves the odds.

Key Takeaways

Factor investing is evidence-based, not theoretical

Quality, Value, and Momentum are proven drivers of returns

High factor scores increase both returns and win probability

Avoiding low-quality, deteriorating stocks is critical

Combining factors with technical analysis improves execution

More Stockopedia videos:

FAQs: Factor Investing & Stockopedia

Is factor investing suitable for traders and investors?

Yes. Factors improve stock selection regardless of timeframe.

Does factor investing replace technical analysis?

No. It complements it by improving the quality of candidates.

How often are StockRanks updated?

Quarterly, ensuring rankings adapt to changing conditions.

Can factor investing beat the index consistently?

Historically, yes — when applied systematically and patiently.

Is momentum risky?

Momentum without quality is risky. Combined with quality, it is powerful.

Rather than trying to identify these factors manually, platforms like Stockopedia make the process objective and repeatable. It’s the service I personally use to filter for quality stocks with improving momentum, before applying my own technical and risk-management framework.

For those interested in thier service be sure to use the coupon code provided below:

Stockopedia Discount Code - HERE

Published by FinancialWisdomTV.com

Quality | Momentum | Probability-Driven Stock Selection

My Breakout Strategy combining fundamental factors and technicals:

Comments