Candlestick Trading Strategies That Actually Work 💰

- FinancialWisdom

- Feb 21, 2025

- 5 min read

Updated: Jan 2

The ONE Pattern That Has Made Me a Fortune

Understanding Candlestick Patterns

In today's video, we discuss candlestick patterns. They are one of the most basic and useful price formations. These patterns can guide potential price moves for any instrument. Traders widely use them in various financial markets, including stocks, forex, and cryptocurrencies. Candlestick patterns can be applied across different timeframes, from intraday to monthly. They help analyze price movements and ride future trends effectively.

A Brief Introduction to Candlestick Charts

For those unfamiliar with candlesticks, let’s start with a basic introduction. A candlestick chart visually represents price movements over a specific time period. Each candlestick shows four key pieces of information: the open, high, low, and close.

This information is depicted with a "body" and "wicks," also known as shadows. The body can either be bullish, typically green or white, or bearish, commonly red or black. In a bullish candlestick, the closing price is higher than the opening price. Conversely, a bearish candlestick indicates that the closing price is lower than the opening price.

The Importance of Market Psychology

Candlestick charts effectively display market sentiment, allowing traders to quickly assess trends and potential reversals. Unlike line charts, candlestick charts provide much more information, helping improve trading decisions.

At the heart of candlestick analysis is understanding market psychology. Patterns form from the struggle between buyers and sellers. A bullish candlestick shows that buyers are in control. The price has risen during the timeframe, reflecting optimistic sentiment. In contrast, a bearish candlestick indicates a decline in price and negative sentiment.

Understanding the psychology behind each pattern is crucial. It helps traders interpret deeper market dynamics. Certain patterns can signal a shift in market psychology. For instance, a market in a downtrend may shift towards a bullish reversal, while an uptrend may shift to a bearish trend.

Confirming Patterns with Indicators

These patterns are more effective when confirmed by other indicators, such as the MACD or moving averages. Candlestick formations form the basis of our breakout strategy— the same strategy I applied in the 2022 US Investing Championships. Our scanner, developed for this purpose, identifies lateral candle consolidation followed by an upside breakout.

The theory is simple: lateral movement indicates an equilibrium between buyers and sellers. An upside breakout confirms that buyers have outnumbered sellers, signaling strength in the trend.

Popular Candlestick Patterns

Let's explore some popular candlestick patterns. We’ll examine their psychology, identification methods, and how traders generally use them.

The Doji Candlestick

Starting with the Doji, this pattern is formed when the open and close prices are nearly identical. As a result, the candlestick features a small body and long wicks. The length of the wicks varies, and Dojis can appear at the top, middle, or bottom of a trend.

There are three types of Doji candlesticks:

Gravestone Doji

Long-legged Doji

Dragonfly Doji

The gravestone and dragonfly Doji suggest a price reversal, while the long-legged Doji signifies indecisiveness. The psychology is straightforward; it highlights the battle between buyers and sellers.

The Hammer and Shooting Star

The Dojis are similar to other candlestick patterns such as the hammer and shooting star. In both cases, the closing price is close to the opening price with a long wick.

On a chart, the hammer indicates a bullish reversal. It forms when sellers fail to push prices down, allowing buyers to bring the price back toward the opening. The shooting star pattern represents the opposite scenario, where buyers fail to maintain prices in an uptrend.

These patterns serve as powerful signals for trend reversals. For instance, if you're eyeing a stock in an uptrend, look for these reversal patterns during consolidations.

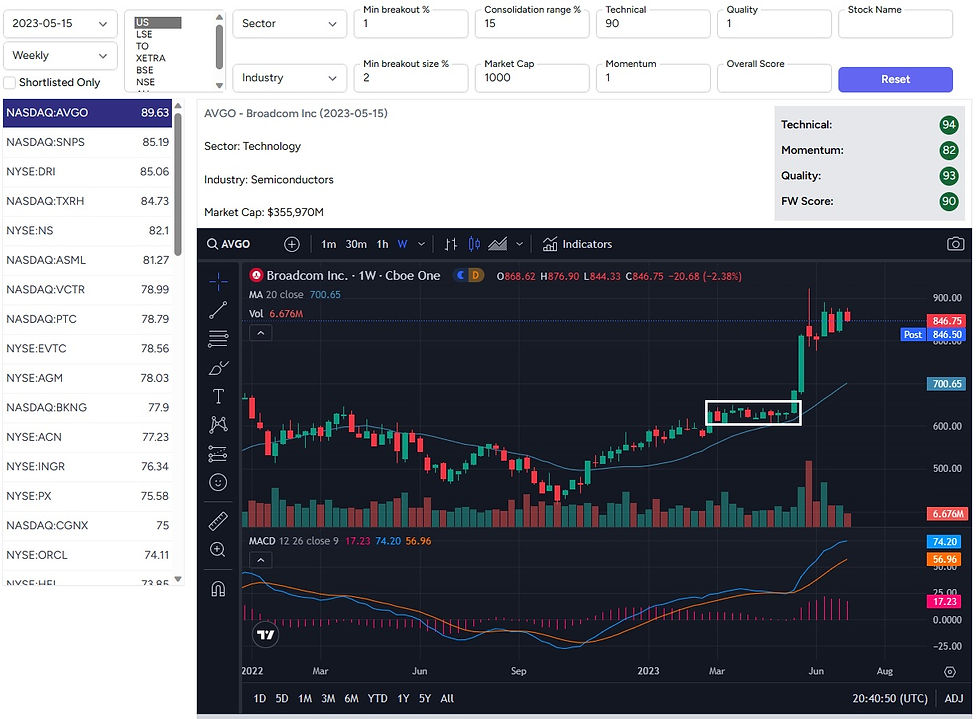

Case Study: Broadcom Inc.

In the weekly chart of Broadcom Inc., the price was in an uptrend after surpassing the last swing high. During consolidation, multiple signals indicated buyer control. Two hammers and one Doji marked the low of this consolidation, leading to a price surge.

A swing trader might enter when the price crosses above the high of a hammer, setting a stop loss below the hammer's low. This strategy could yield a high reward-to-risk ratio, as the stock rose 50% in five weeks.

Engulfing Patterns

Moving on, we have the Engulfing pattern, a rare yet powerful trend reversal indicator. It consists of two candlesticks, where the second one completely engulfs the body of the first.

In a Bullish Engulfing pattern, the second candlestick is a large bullish candle that engulfs a smaller bearish one, signaling a potential reversal from a downtrend. The reverse occurs in a Bearish Engulfing pattern.

This pattern depicts a clear market sentiment shift. The bullish engulfing shows that buyers have overwhelmed sellers, suggesting strong upward pressure.

Morning Star and Evening Star Patterns

Next up are the Morning Star and Evening Star patterns. These are three-candle reversal patterns.

The Morning Star pattern forms as follows:

A large bearish candlestick.

A small candlestick (either bullish or bearish) that gaps down.

A large bullish candlestick that closes above the midpoint of the first candlestick.

The Evening Star pattern is its opposite, comprising:

A large bullish candlestick.

A small candlestick (either bullish or bearish) that gaps up.

A large bearish candlestick closing below the midpoint of the first candlestick.

The psychology behind the Morning Star indicates weakening selling pressure. Conversely, the Evening Star suggests a reversal in buyer control.

Example: Reddit Inc.

In a weekly chart of Reddit Inc., a significant red candle signaled a short downtrend, followed by a small gap down. Buyers quickly took control, resulting in a hammer formation. This was followed by a strong green candle that confirmed buyer dominance. Together, these three candles formed a Morning Star pattern, after which the price quadrupled.

Inside Candle Patterns

A powerful continuation pattern is the Inside Candle pattern. This trend-following pattern forms when a small candle is created within the highs and lows of a previous trending candle.

This pattern resembles a tight consolidation. The goal is to enter the trend at the previous candle's high, with a stop loss set at the low of the inside candle.

For instance, in a chart of Palantir Technologies, an inside candle formed within a bullish candle’s range. The price continued upward after this brief consolidation.

Final Thoughts on Candlestick Patterns

Candlestick patterns are vital tools in technical analysis. Understanding these patterns can provide valuable insights into market psychology and potential price movements. Traders can make informed decisions regarding entering and exiting trades.

These patterns perform exceptionally well on broader time horizons, mitigating daily volatility and revealing the market's psychology. However, they require patience, as they are rare on larger scales. The rewards can be substantial, which is why our members utilize our scanner weekly.

For those keen on establishing candlestick probabilities, check out one of our previous videos that focus on this topic.

While these patterns can be powerful, remember that anything can happen. Your risk management must always be solid.

After 30 years of trading, I follow similar principles. I look for high-quality stocks exhibiting robust momentum and low-risk entry points. If you’re interested, you can access our group or follow my trades using the links below.

Access Our Group Here - Financial Wisdom TV

My Brokerage Account (Interactive Brokers) - Interactive Brokers

My Breakout Scanner - Breakout Scanner

My FREE Strategy Blueprint - Strategy Blueprint

Comments