Trade Entry Techniques for Swing Traders

- Jul 22, 2022

- 5 min read

What are they....?

Trade Entry Techniques for Swing Trader

A swing trader generally looks for short-term trades that last from a few days to a few weeks, with a sole focus of gaining a multiple of risk taken and maintaining a decent winning rate. When you are swing trading, you would be looking for trades that provide you the best bang for the buck and also don’t put you in too much trouble if some of the trades go sour.

To keep the risk-reward manageable, you need to focus on specific entry points based on the technical setup of the stock.

For example, Mark Minervini uses his Specific Entry Point Analysis (SEPA) to zero down on the exact point he would be interested in a potential trade. That point is based on how the price has behaved in consolidation and in the move before the consolidation. Mark, like most swing traders, is a continuation trader and bets only on continuation moves. Therefore, it’s a prerequisite for the stock to be in a long-term uptrend for him to go long or in a long-term downtrend to go short.

Here is one of the trades (GSG) that Mark took recently. The stock displayed his famous VCP pattern and tightened on the right side, producing an extremely favorable risk-reward equation. The risk on this trade would be around 1%, and the stock rallied up almost 8% after it passed the breakout point. That’s around 8x reward for the risk taken, although such tight trades can offer a low win rate and this needs to be considered.

This trade was taken in choppy markets during 2022 and so the move was also limited. In trending markets, such set-ups can present opportunities that can carry rewards of as much as 50-100 times the risk taken.

As a swing trader, you should hunt for such opportunities to enter at the best possible time, right before the stock is about to make a move.

While you can always devise your entry techniques after some practice, here are some common entry techniques you can master to kick start your trading.

Breakouts: Buying strength after a consolidation.

Breakouts are the most common entry points for many swing traders. It’s simply placing your trade at a point when the price is breaking out of an established zone to continue its trend higher or lower. (The approach I take)

It’s mostly followed by trend-following swing traders, who wait for the price to digest supply or demand from the previous move, and place their trades at the right time when a fresh demand is ready to take the price higher, or fresh supply is ready to take the price lower.

As mentioned earlier, for the breakouts to work, it’s essential to check the primary trend of the stock and place the trade accordingly in the direction. It will be hard to make money shorting a stock that is trending upwards in its primary trend. Therefore, the starting point should always be the primary trend.

Pullbacks: Buying a turnaround in a consolidation

Some traders prefer to buy trending stocks, not at the breakout but when they are still in the consolidation within a primary trend. Buying a pullback is a skilful trait of a trader as one can’t randomly buy a falling stock.

Most new traders assume that the pullback buy point is anytime the stock pulls back from its previous high, which is a flawed understanding. One must educate themselves on how to spot a secondary trend pullback and a stage 4 downtrend.

A secondary trend pullback is a mild correction when the stock digests its previous move to start another move higher while a stage 4 downtrend is when the stock has concluded its move up and now is on its way down.

Traders buy secondary trend pullbacks at the point they feel that the stock has made a bottom/top and is ripe for the next move up/down. For example, in the chart below, the pullback buy would be at the point when the price did not cut its bottom and turned around to go on its way to hitting a higher high within the correction. The breakout from the base would have come much later here.

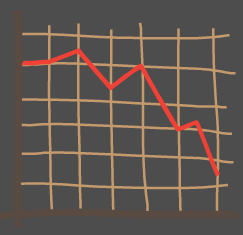

Here is another chart of a stock showing multiple consolidations within an uptrend and a precipitous stage 4 downtrend. It gets very clear in the chart that not differentiating between a secondary pullback and a stage 4 downtrend can be disastrous. I use the 20 week MA and MACD to help this process.

Gap ups: Buying outstanding strength after an event took place

Gap-ups can be another good point to buy stocks that have their fortunes changed suddenly. In gap-ups too, you must differentiate between gap-ups early in the move and late in the move. Gap-ups late in the move are a sign of exhaustion and are generally followed by large declines or long periods of non-performance.

To play a gap-up, you can put in a position right at the gap-up or wait for the stock to consolidate, build a base and then enter.

For example, in the chart below, one could have entered the trade right into gap-up at the open or could have waited for a few days to enter the next buy point. However, if there are solid reasons for the gap-up, one must not wait for an alternative entry because such stocks don’t set-up immediately after the gap-up and sometimes run for months before halting.

Supports and resistance

Not all swing traders trade continuation trends and some aim to profit from stocks that stay in sideways consolidations for long periods. Traders identify such stocks using a set of technical parameters and buy them when they approach support levels and sell them when they approach resistance levels.

The stocks that fit the criterion here will mostly be old economy stocks that tend to get stuck in a range for periods stretching to a few years, before making their move and getting stuck in another range.

Conclusion

The entries explained above are not exhaustive and you can build your own granular entry systems keeping some of the concepts discussed above as a base. As you practice more and more, the entry part will keep getting fine-tuned and improved, bringing in a big change in your trading.

No matter which entry criterion you choose, it will always be prone to failure as trading is a game of probabilities. Therefore, you must keep your stop losses tight (relative to reward) and not get comfortable, no matter how many entries you have gotten right.

For those looking for a proven strategy or a forum with likeminded individuals, be sure to join!

My breakout strategy - 15 page rule book (PDF) is available for all members to use.

My Breakout Scanner - https://bit.ly/3ea6sl8

My Forum - https://www.financialwisdomTV.com/forum

My Strategy Blueprint - https://www.financialwisdomtv.com/plans-pricing

My Brokerage Account (Interactive Brokers) - https://bit.ly/3HVA1nc

I wonder what effect volume has on the probability of price moves?