Future Growth Stocks Using ChatGPT & Artificial Intelligence

- Apr 21, 2023

- 5 min read

Updated: Jan 18

20 Growth Stocks for the next 20 years?

This article explores whether artificial intelligence can identify the next generation of long-term high-growth stocks. By analysing the traits of the best-performing companies over the past 20 years and removing emotional bias, an AI-selected portfolio is tested against real historical data. The results highlight how combining data-driven stock selection with simple risk management techniques can dramatically improve long-term returns while reducing drawdowns. The study offers a practical framework for using AI as a decision-support tool rather than a prediction engine.

Can AI Identify the Next Generation of High-Growth Stocks?

Trying to identify the next generation of high-growth stocks over a 20-year horizon is one of the hardest challenges in investing. Even the world’s best fund managers struggle to do it consistently.

In this study, we take a different approach.

Instead of relying on human intuition, emotion, or narrative bias, we ask one of the most advanced artificial intelligence models available — ChatGPT-4 — to identify potential long-term growth stocks using purely data-driven reasoning.

We also test whether this approach has any historical merit by analysing how a ChatGPT-style portfolio selection would have performed over the past 20 years, both with and without risk management.

Step 1: Teaching AI What “Great Growth Stocks” Look Like

Before asking AI to predict the future, the first step was to define the characteristics of successful growth stocks.

To do this, ChatGPT was asked to list the most notable high-growth stocks of the last 20 years. Unsurprisingly, the response included many familiar names:

Apple

Amazon

Netflix

Tesla

Google (Alphabet)

Microsoft

Nvidia

Meta (Facebook)

These stocks were ranked by approximate growth and then fed into back-testing software to examine overall portfolio performance.

Portfolio Test 1: The “Perfect Hindsight” Portfolio

This first portfolio was created with hindsight, so exceptional results were expected. The goal was not realism — it was to prime the AI for what long-term success looks like.

Results:

Initial capital: $100,000

Allocation: 5% per stock

Time period: 20 years

Final portfolio value: Over $19 million

Clearly spectacular — but expected.

Adding Risk Management: EMA Crossover Filter

To test robustness, we applied a 10 / 20-week EMA crossover on the S&P 500 as a market-risk filter:

When the 10-week EMA crossed below the 20-week EMA → all positions exited

Re-entered when the trend turned positive again

Impact:

Drawdown reduced from ~58% to ~24%

Portfolio still grew to over $10 million

This reinforced a key point: risk management matters as much as stock selection.

More on the EMA strategy can be seen in this video:

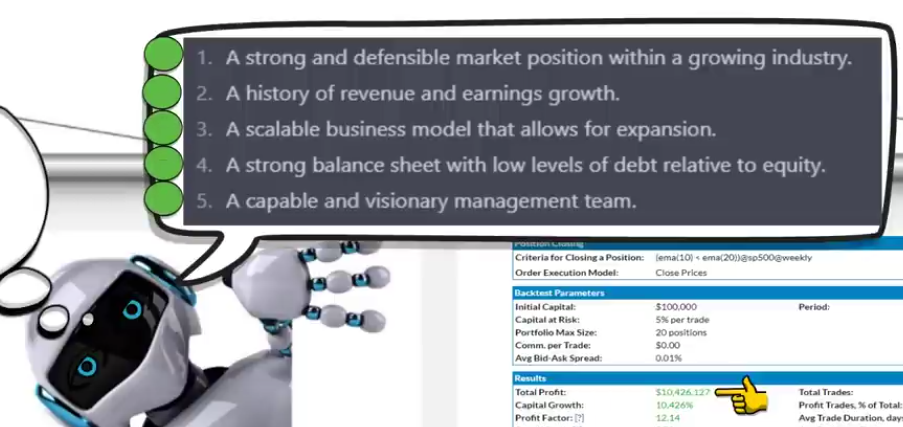

Step 2: Removing Hindsight Bias

Next, ChatGPT was asked a far more interesting question:

Which stocks would you have selected 20 years ago, based only on the characteristics of great growth companies — without knowing the future?

The AI identified a fresh list of 20 stocks based on common success factors:

Strong competitive positioning

Scalable business models

Consistent revenue and earnings growth

Manageable debt

Visionary management

Long-term industry tailwinds

Portfolio Test 2: AI-Selected Growth Stocks (No Hindsight)

Results:

Total return: ~5,000%

Maximum drawdown: ~52%

Apple alone turned a $5,000 position into ~$3.5 million

Even without knowing the future, this portfolio significantly outperformed the market.

With EMA Risk Management:

Drawdown reduced by ~20%

2008 crash largely avoided

Returns still far exceeded the S&P 500

This suggested that AI-driven selection + simple trend filtering can materially improve long-term outcomes.

Step 3: Can AI Pick the Next 20 Years?

With encouraging historical results, we then asked the most speculative question:

Which stocks could be the next major growth winners over the next 20 years?

The response included a mix of established leaders and emerging innovators. Notably, Apple was excluded.

When asked why, ChatGPT explained:

Apple’s size and maturity may limit future exponential growth

Emerging companies in faster-growing sectors may offer better upside

Innovation velocity and adaptability matter more than legacy dominance

Sector Bias: Why So Much Technology?

One concern stood out: around 75% of the AI-selected stocks came from the technology sector.

When questioned, ChatGPT cited:

Scalability of digital business models

Faster innovation cycles

Strong network effects

Capital-light growth potential

AI and automation tailwinds

Given historical evidence, the explanation was logically consistent.

Cross-Checking with Stockopedia

To validate the selections further, the stocks were analysed using Stockopedia, focusing on:

Quality

Momentum

Value

Observations:

Most stocks ranked well on Quality & Momentum

Many appeared expensive on Value metrics — typical of high-growth stocks

Piotroski scores were generally strong

Only one stock (CRISPR Therapeutics) flirted with “junk” territory

This confirmed that AI selections broadly aligned with proven factor performance.

25% Stockopedia Discount Code for our members here - https://bit.ly/2YIcAIn

What Can We Learn From This?

We are still at the very beginning of AI-assisted investing — but several insights are already clear:

AI can rapidly synthesise vast amounts of information

It can identify long-term growth characteristics objectively

When combined with simple risk management, results improve dramatically

AI does not replace discipline — it enhances decision-making

Will this portfolio outperform over the next 20 years?

No one knows.

But what is clear is that AI can dramatically speed up analysis, remove emotional bias, and help investors focus on probability rather than prediction.

We may only be scratching the surface — but the potential is undeniable.

Frequently Asked Questions (FAQs)

Can AI really pick winning stocks? AI cannot predict the future, but it can identify common characteristics shared by historically successful companies and apply those filters consistently without emotion or bias.

Did the AI portfolio outperform the market historically? Yes. When tested without hindsight bias, the AI-selected portfolio significantly outperformed the S&P 500 over a 20-year period, even before applying risk management.

Why was Apple excluded from the future AI portfolio? Apple’s size and maturity limit its ability to deliver exponential growth compared to smaller, faster-moving companies in emerging sectors.

Why are most AI picks technology stocks? Technology companies benefit from scalability, innovation, network effects, and long-term structural growth trends, which align with high-growth characteristics.

Is this a buy-and-hold strategy? No. Results improved substantially when combined with a simple market trend filter such as the 10- and 20-week EMA crossover.

Does AI replace fundamental or technical analysis? No. AI complements traditional analysis by accelerating research and removing emotional bias, but disciplined execution and risk management remain essential.

Can individual investors realistically apply this approach? Yes. The process is accessible and can be enhanced using platforms like Stockopedia for factor validation and portfolio monitoring.

Is this approach suitable for beginners? It’s best suited for investors who already understand basic market principles and want to improve long-term decision-making with data-driven tools.

Related Reading

Inside the Financial Wisdom Weekly Consolidation Breakout Framework

Risk Management in Trading: The Foundation of Long-Term Profitability

Published by FinancialWisdomTV.com Trading Education | Risk Management | Trading Psychology

Started on April 20 2023 at closing price approximate $10,000 USD in each of the 20 Chat GPT picks.

This is the June 9 2023 update ( approximate 8 weeks )

I created that 20 stock portfolio buying $10,000 USD in each of the 20 tickers listed. An initial price of the April 20th 2023 closing price was used to intitiate the positions. As of today May 18, 2023 the portfolio is up a very respectable 9.29%.